To ensure that collateral is adequately insured, financial institutions cooperate with MyInsuranceInfo, an insurance verification service. They assist thousands of consumers in confirming their insurance coverage by using the safe and user-friendly MyInsuranceInfo platform.

MyInsuranceInfo

When you apply for a loan from your financial institution, you must have a specific level of insurance coverage. You can use this service to check whether you have enough insurance coverage for that loan by submitting your insurance information online at your convenience. Via the MyInsuranceInfo website at www.myinsuranceinfo.com, we can regularly confirm insurance coverage for thousands of individuals.

Members can interact with MyInsuranceInfo and receive quick response using this service. You can get immediate information because our website is open twenty-four hours a day, seven days a week. To access it, go to www.myinsuranceinfo.com.

Financial organisations want insurance when you apply for a loan. You can check to see if you have enough insurance with MyInsuranceInfo.

This article serves as an explanation of the MyInsuranceInfo insurance verification procedure. You can submit the necessary insurance documentation for your loan through a quick and safe online method.

The Steps for MyInsuranceInfo Insurance Verification

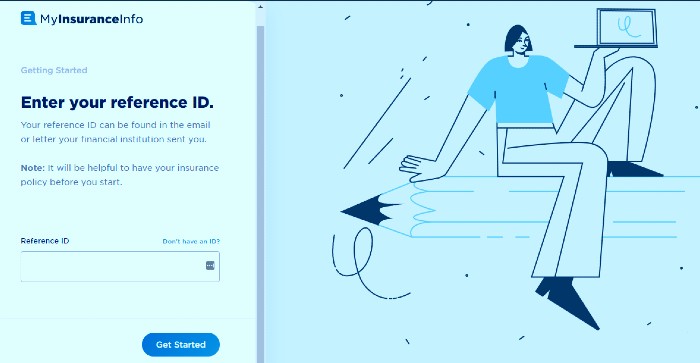

What to anticipate during the verification procedure is listed below. It goes without saying that you must go to the official website, www.myinsuranceinfo.com, and then carry out the following actions: Step 1: assemble your papers

You need certain records in order to properly verify your insurance coverage: Your banking institution’s notification: Your special reference ID can be found on this document, whether you receive it by mail or email. The sort of collateral (vehicle, house, boat, RV, etc.) required for the loan will also be specified in this form.

Insurance Policy Paperwork Your insurance company’s name, the policy number, the date it went into force, the deductible amount or amounts, and the name of the organisation that has the lien on the collateral are all information they will require. You may find all of this information on the declarations page of your insurance policy documentation.

Step 2: Provide Basic Insurance Details

You will be required to enter the data from those documents into the MyInsuranceInfo portal during a guided process that takes around five minutes. The most recent details concerning your insurance policy should be given to your lender.

Step 3: Examine and Send

You have finished the task once you have reviewed and submitted your data. Once your information has been accurately entered, you will receive an email confirming it, and MyInsuranceInfo will begin updating your loan information.

After submitting your data, you will receive a follow-up email within 2–3 business days to let you know whether everything went according to plan or if any further action is required.

What Motivates Insurance Verification?

You are probably reading this because your financial institution asked you to confirm your insurance coverage in a letter or email that you received. MyInsuranceInfo makes sure that your insurance information is correct and that you are adequately insured by working with your financial institution.

Your loan agreement to purchase your collateral, such as a house, car, boat, or recreational vehicle, required you to provide proof of insurance to guarantee the security of your collateral. For a variety of reasons, your lender doesn’t know if you currently have the insurance coverage you promised to have.

There is an easy method to get the facts right. After completing MyInsuranceInfo’s simple verification process, you will be sent a certificate of coverage, and your financial institution will have the most recent data about you. You could have gotten a letter asking you to confirm your insurance for the reasons listed below: Refinance your current loan or apply for a new one.

You will need to show proof of insurance on the collateral within a set amount of time after taking out a new loan. If your financial institution has not acquired the insurance information, you might get a notification. Your financial institution will receive the updated proof of insurance when you submit your insurance coverage information into the MyInsuranceInfo site, so there is no need for you to take any more action.

You deleted any necessary insurance from your policy.

If you just modified your insurance coverage, be sure it complies with the terms of your loan agreement. You can get a warning if your new policy has a high deductible because some contracts provide for specific deductible sums. Any of these inconsistencies can be found by looking over your loan agreement.

Your policy was cancelled by your current insurance provider.

If you recently terminated an insurance coverage, you can also get a notice. As long as you have enough coverage, you can update your information via the MyInsuranceInfo site, and we’ll notify your financial institution when we do so.

Your insurance policy didn’t list your financial institution as a lienholder. The organisation or establishment that provided you with a loan for this specific purchase is known as the “lienholder,” typically a bank or credit union. Your banking institution won’t be updated on insurance policy changes if it’s not designated as the lienholder. If you want to know if your financial institution is on the list of lienholders, look it up on the declarations page of your insurance policy. Fill out the verification process on this website if they are not mentioned, then call your insurance provider to have your lienholder added to your policy.

Invalid Insurance

If your provider is a “non-continuous insurance carrier,” the insurance contract might not renew on its own. This notification may have been sent to you if you have an insurance policy with a non-continuous insurer because your coverage has run out.

Regular Re-examination Of The Insurance Policy

You will still be requested to verify your coverage every three years whether or not you have a continuous insurance provider, in which case your policy renews every three years. As a result, they will send you a letter to confirm your coverage if they have had the same insurance information on file for three years without updating it. Nothing you did was wrong. This step’s goal is to confirm that your protection is still sufficient. You must finish the quick verification process in order to proceed.

What Is Insurance for Collateral Protection?

Lenders utilise collateral-placed insurance (CPI), often referred to as collateral protection insurance or force-placed insurance, as a last resort to safeguard the collateral they have acquired through loans. As the CPI only protects what you buy, it does not offer full coverage. The policy does not offer liability protection, and it does not shield you or others from harm.

CPI costs substantially more than conventional insurance does. In contrast to typical insurance, which only protects the collateral’s actual cash value, you are actually safeguarding the whole value of your collateral because it covers the entire outstanding loan amount.

If you have CPI, your loan payments will go up each month. If you’ve seen this unexpected increase in your rate, you might want to change your insurance coverage information through the MyInsuranceInfo portal.

These risks are in addition to the CPI-related price increase that this coverage entails. If an accident occurs and causes damage or injuries, you can still be personally liable for covering the cost of the damage or any related medical costs.

You run a higher risk because CPI only covers your collateral and not you. So, it is essential to do away with CPI as soon as feasible. When someone receives a notification requesting them to confirm their insurance coverage, the situation is typically settled without the need for CPI. If you are charged CPI, you should find a solution right away. By completing the safe insurance verification process offered by MyInsuranceInfo and making sure that everyone is aware of your insurance coverage, you can avoid paying for CPI.

Questions and Answers About MyInsuranceInfo

Where can I obtain the reference ID for MyInsuranceInfo?

Your special reference ID can be found in the upper right-hand corner of any correspondence you have received from your financial institution, whether it was a letter in the mail or an email.

How long does it typically take to confirm the insurance?

You shouldn’t need more than five minutes to submit on the My Insurance Info website, at www.myinsuranceinfo.com. When they get your insurance information, they will send you a confirmation email. Within another two to three business days, the MyInsuranceInfo insurance verification process will be finished. Your subsequent email will confirm whether additional action is not required or whether more details are required. Further instructions and a phone number to call if you need additional information will be sent to you.

What details do I need to confirm my insurance?

They typically need you to give the following, though it may differ based on the sort of collateral you’re insuring (house vs. car, for example): Your special reference number

- The insurance provider’s name

- the policy identifier

- The day the policy went into effect

- Maximum deduction (s)

Make sure your bank is identified as a lienholder by checking The declarations page of your insurance policy contains this information.

What are the papers that make up a car insurance policy?

Your insurance policy documentation will clarify the specifics of your coverage. The declarations page of these documents lists the coverages, limits, and deductibles of your policy. Your agent’s contact information is also listed on your insurance policy.

Concerning Allied Solutions

Eldredge Corporation and FLS Services merged to establish Allied Solutions in 2001. They created a successful business model focused on offering great customer service and solutions that are specifically suited to the requirements of each client in order to help them conduct business and manage risks more successfully.

More than 4,000 financial institutions in North America rely on Allied Solutions’ technology solutions and services for their insurance, credit, and marketing requirements. MyInsuranceInfo is run by Allied Solutions, a division of Securian Financial Group, Inc. that has a number of regional offices and service centres spread out around the nation. Allied Solutions is committed to assisting clients with expanding, safeguarding, and growing their businesses.

Securian Financial Group, Inc.’s subsidiary Allied Solutions has 16 regional offices and service centres across the country. With Allied Solutions, there are more than 1,300 employees. Securian Financial Group, Inc. is Allied Solution’s parent firm. The company’s annual revenue is thought to be $226.8 million.

More than 4,000 clients in North America are served by this subsidiary of Securian Financial Group, which is fully owned and independently run. They are able to offer the most cutting-edge and affordable goods and services on the market right now because of their independence and the breadth of our clientele.

Last Remarks: MyInsuranceInfo

MyInsuranceInfo’s goal is to make sure you have adequate insurance protection for your house, car, RV, or any other significant asset. You can submit your information via their platform at your convenience and without losing valuable time waiting to speak to someone. Verifying your insurance coverage and making sure your banking institution has your most recent information both take less than five minutes.

You might have received notification from your financial institution that you need to update your information. MyInsuranceInfo verifies thousands of people each month. For one of the aforementioned reasons, you might have gotten a notice. By completing the quick verification procedure through the MyInsuranceInfo portal, you may clear up this misconception.