PaycheckRecords – Companies are obligated to save workers’ pay records and other paperwork for a certain period of time by the Office of Official Compensation and the Fair Labor Standards Act. The authentic IRS also mandates that the company maintain payroll records for all currently employed personnel.

PaycheckRecords

Verify that the paperwork submitted for Paycheckrecords complies with IRS and FLSA regulations. After six years of completion, all workers must update any pertinent job assignments or portal changes.

Employers must keep an eye on free invoices and payments. However, the majority of legal paperwork is held by employees as part of their work, therefore the contract shouldn’t need to be printed again.

The employee login portal for QuickBooks Workforce provides a platform for online payroll access. Workers have unlimited access to both recent and old Paycheck Records. But, your manager needs to add the first worker/contractor before they may access your portal. To properly complete the QuickBooks salary recording procedure, read this article.

A business that offers its financial software knowledge is Intuit. In 1983, Scott Cook and Tom Proulx started it. Software for handling finances, accounting, and taxes is sold by an American business with a Mountain View, California, basis.

Knowing Portal Information

Contractors and individual employees can keep track of their payroll and stay current online with the aid of Paycheckrecords. Keep in mind that this is not just for business owners. It is currently in progress.

You cannot continuously send the invitation email to report current payroll as an employer. You can stop searching your inbox once you have a paid account. because your control panel’s Check Registers window allows you to access your payroll.

Create An Employee Account Using The Steps Shown Below

To make it easier for users to get started with Paycheckrecords, I must break the notes into 4 sections. In a few clicks, you can access your Paycheckrecords.

- Log in to your account as the employer or administrator.

- See the staff.

- Choose the name of the employee from the list.

- Click the Edit button next to the header to access the Paycheckrecords.

- To authorise access, choose the Display payment receipts online option here.

- Enter your email address now, then click Save.

To access your login portal, click here.

An internet platform called Paycheckrecords makes it possible for firm employees and small business owners to examine paychecks. Your recent and current pay stubs are accessible, viewable, and printable through this secure online account. Your employer must, however, give you permission to use this service before you can access this account.

For now, business owners cannot use this service. Your payment receipts are available to view and print every day. To view and print your previous and current pay stubs, enter your account online by following the instructions in this helpful article.

Employees and independent contractors can view and print their payroll online using this secure website. By including them in Intuit’s full-service payroll, the corporation or business is required to grant you access to Paycheckrecords. A temporary login and password are sent to the employee or contractor through email. The instructions for signing in and setting up a new, distinctive username and password are also included in this email. Simply click the link in this email to get the login information you need to access your account online.

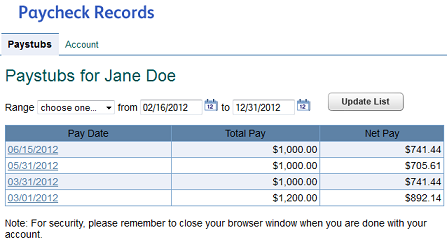

You can quickly view the Paycheckrecords for which you have been approved by logging into your account online on this website once you have been given permission to access your paystubs. You can also choose the time frame that will return rapid results based on your search in order to see certain wage ranges. Please be aware that until they are terminated from the corporation or business, inactive or laid-off contractors or workers have access to this service.

Terms And Conditions For Login Registration

Any business owner or manager needs to pay close attention to how to effectively manage their payroll. Payroll records should be preserved for at least 6 years following job termination. Payroll and break tracking are required.

The information on employee compensation and withholdings from wages is included on pay stubs. These documents are required by payroll staff in order to determine the gross and net wages for each employee. Funeral payments, bonuses, commissions, pension deductions, debit authorization forms, gross wages, hours worked, paycheck payments, net wages paid, wage payments, sick leave, or vacation are a few of the primary Paycheckrecords types. Every employer is required to keep all of its employees’ paperwork up to date. The Paycheckrecords login procedure is as follows:

Visit the official QuickBooks Workforce employee login website as the first step.

Step 2: Locate and select the blue-highlighted “Login” button.

Step 3: Enter your login or email address into the first field.

Step 4: Fill out the second field with your password. You can log in with your QuickBooks, Mint, or TurboTax password.

Step 5: Just on your own system/device, enable the “Remember Me” feature. Your access information will be saved in the system if you select this option, and it could end up in the hands of someone you don’t want.

Step 6: Choose the “Connection” tab after confirming the entries.

To access the portal, just follow the steps listed below.

You must take these quick steps to confirm that you are logged in before you can access your payment records properly: Ensure that you have a quick internet connection before anything else.

- Following that, launch your web browser and go to the official website.

- Your browser will take you to the website’s home page.

- There, you must first enter your login or email address.

- Next, enter your password in the corresponding field.

- In the end, click the Login button.

- upon successful login.

How Do I Change a Lost Password?

Tap if you’ve forgotten your login credentials. Don’t know your user ID? To acquire the details about this operation, just follow these easy steps.

- Enter your registered account’s email address first.

- After that, press the “Send an email” button.

- You must then check your inbox for new email.

- Moreover, your username issue can be easily resolved.

Tap here if you’ve lost your password. I forgot my password. Here, you must adhere to the subsequent steps: Bring up the name.

- After that, select “Next.”

- To obtain the data, you must perform these programmes.

- Which pay stubs ought to employers keep in their payroll records?

The following records must be kept for each non-exempt employee, according to the United States Department of Labor, in accordance with the Fair Labor Standards Act (FLSA, through your, through, through, through your insured employer): Information that can be used to identify an employee, including full name, social security number, address (including zip code), date of birth (if under 19), gender, and occupation.

Employee hours include the time and day of the week on which their workweek starts, the number of hours they put in each day, and the sum of their weekly working hours.

Wages and income of employees: The basis for paying employee wages (for example, employee wages).

Pay periods for employees include the total compensation paid during each pay period, the pay date, and the salary period covered.

Businesses must also save personnel documents, including copies of their resumes, cover letters, and employment certificates.

Also, according to Williams, companies “shall save signed copies of each employee’s Form W-4 indicating federal withholdings and any paperwork indicating deductions from wages, benefits, and gifts.” In cases of promotions and demotions, the employer must also provide a detailed justification for any wage changes.

Advantages Of Using The Login Portal

- Workers can check their vacation and sick leave requests.

- online payment receipts can be seen and printed

- Also, you can check your taxes and other data online.

- You have access to your W-2 and can even download a digital copy.

The Paycheckrecords procedure has numerous ramifications. For instance, the provisions necessary to preserve payroll. Employee records including time cards, working hours, and other documentation can be stored in paper or electronic form for at least two years. Government officials should be allowed to seek access to these Paycheckrecords and review them.

Keep in mind to store any Paycheckrecords safely. All of these records must be kept separately from other business records. Today’s payroll experts use features of the highest calibre to improve the way they handle payroll. Find out the general accuracy of all the data categories, including the address, title, and pay rate of the employee.

Services provided by pay records:

Accessible through EasyStart, Essentials, and Advanced formats, QuickBooks Online is an online accounting and financial management tool for small businesses.

Using your mobile device to make payments and handle emergencies is Intuit GoPayment.

QuickBooks Payroll Solutions: Add Internal Financial Income to QuickBooks Pro and Premier.

When Should Records Be Kept?

Federal laws specify what must be retained, how it must be retained, and how long it must be retained. It is advised that all records be kept in line with the Extended Retention Act because record retention rules differ from state to state.

Williams stated that according to federal labour law, companies are required to maintain records of their employees’ three-year salaries as well as other information such name, address, date of birth, occupation, pay rate, and weekly allowance.

Employers must maintain employee records for at least four years following the fourth quarter of the tax year, according to the IRS. Despite the FLSA’s three-year requirement, the IRS demands four years of record-keeping.

Keep in mind that each state has its own regulations regarding employee record keeping. Dimitt cites California as an illustration.

“The California payroll should disclose how many sick days and vacation days the employee has taken,” he said. Keeping Paycheck records for three years is legally required in California, although six years is the recommended time frame.

Get the user name and password

in the event that you forget who you are. A username and password are not available to you. You need to find your forgotten login details in order to reclaim access to your Intuit Workforce account. To fast recover it, adhere to the methods listed below.

First, open a new browser tab and type workforce.intuit.com. Press Enter.

Step 2: Locate and click on the “I forgot my login or password” link under the “Login” button.

Step 3: On this page, you can now input your phone number, email address, or username. Click Next after entering any. Enter your phone number or username if you can’t remember your username. via email.

Step 4: Choose “Try something different” from the list of links below the box if you can’t remember any of the numbers or IDs shown above.

Step 5: Fill out the page with your last name, birthdate, SSN, and ZIP code before pressing the “Next” button. Please be aware that the Next button won’t activate until you’ve completed all the essential fields.

Step 6: Complete the process by carrying out the following steps in the order specified on the page.

Check Out The Portal’s Features

In order to transport individual data over the Internet, Paycheckrecords.com’s QuickBooks Online follows the same methodology as online businesses and banks. Intuit securely backs up your most recent data in the payment history connection and keeps two copies of it.

Your report is safeguarded against regrets, programmers, and fraudulent activities by being stored on replicated Paycheckrecords.com servers that are surrounded by firewalls. We are updating the employee data with the modifications, so we are unable to first build the employee file.

Using a Linux PC owned by a Paycheckrecords.com employee, a database server will be used to store shared occupancy records. See Running QuickBooks on Linux and Design for Introducing the Linux Database Server for more details.

The location of your firm is displayed in a thorough compilation of detailed statements in QuickBooks Online. Whenever, discuss them with your coworkers or your company’s accountant.

Although it is not necessary to register for an account, employees should update the Paycheckrecords portal everyday with information pertaining to their jobs. Your staff can utilise the QuickBooks online platform once they have learned how to evaluate, classify, and categorise claims as well as how to keep receipts.

How Do Employee Portals Function?

Active Directory and salary savings are combined well by Paycheckrecords.com. www.paycheckrecords.com Register an account with Paycheckrecords. Logging in increases the security of your data on the portal significantly while also saving time and money.

It probably makes sense to have a straightforward corporate account for something as crucial as mortgage information. The online connection to track salaries now should be easy for qualified workers to use. By completing the payment registration process with a username and password, existing customers can access the gateway.

Paycheckrecords.com is one of the countless websites and settings for which SAASPASS ID Manager can be set up to automatically log in and out on both your PC and mobile devices. It’s a fantastic method for navigating the network’s many complexity.

The addition of multi-factor authentication settings for authenticators as well as through a password manager is also a simple process for employees. Authentication codes and password identifiers can even be automatically penetrated and bound on the portal itself.