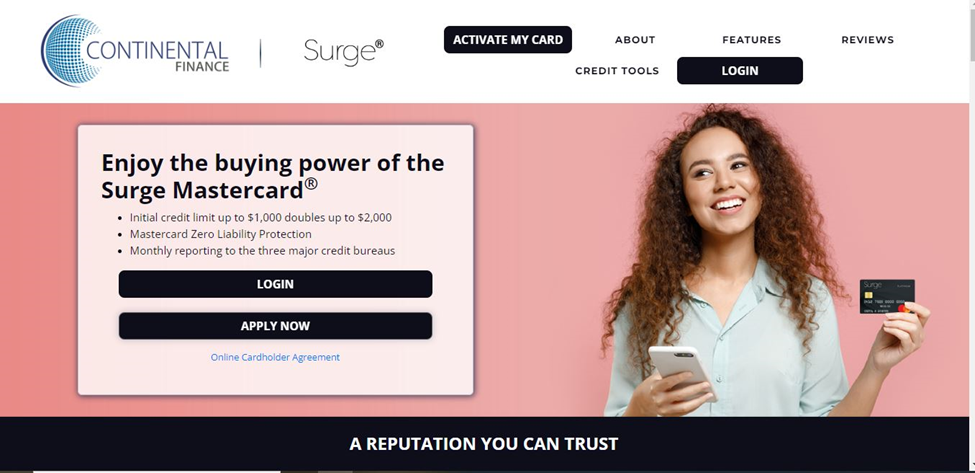

SurgeCardInfo – Celtic Bank offers the Surge Mastercard, a credit card for people with bad or no credit who want to build or rebuild their credit.

SurgeCardInfo

With regards to applying for a line of credit or further developing one’s FICO score, the Flood Mastercard from Flood Card Data is an incredible choice for individuals hoping to get everything rolling.

The Surge card, which can be found at www.surgecardinfo.com, is issued by Continental Finance. Or, it could be that this credit card will help you improve your credit score, but it will cost you a lot of money.

You might check your Flood account balance, make online installments, and get electronic proclamations subsequent to enlisting your Flood card on the web. Cardholders can access their online accounts through the Surge Mastercard Log In feature.

To view your Surge Mastercard statements, make payments, check your payment due dates, and do a lot more, you must sign in to your account.

Benefits of SurgeCardInfo

Your credit card won’t be charged for any unapproved exchanges at SurgeCardInfo.

When you sign up for eStatements, you’ll get access to your Experian Vantage 3.0 score for free.

The three major credit reporting agencies receive reports of all monthly payments: SurgeCardInfo has approved Equifax, Experian, and TransUnion.

A reasonable starting point is a $300 credit limit on a high-risk credit card.

If you pay on time, you could get a bigger credit limit in just six months.

After registering your Surge card online, you can check the balance of your account online, pay online, and get electronic statements.

A SurgeCardInfo customer service representative may also need to check your account number and the last four digits of your social security number in order to cancel your account.

Card Activation of SurgeCardInfo

If you got this card from the SurgeCardInfo Login page, you can’t use it right away. Before you can use it, you need to activate it. Your Flood card can be utilized following it has been enacted. Instant activation is possible with surge credit cards.

You can easily activate your Surge Credit Card login, but your card credentials are also required for activation. You are required to activate your Surge credit card before attempting to log in. A Surge credit card can also be activated quickly and easily thanks to the online process.

Visit to the SurgeCardInfo activation page using your web browser. The Surge credit card activation page can be found on this page. On that webpage, you will then see three credentials.

To activate the Last 4 of your credit card, 5 digit zip code, and Last 4 of your social security number, please enter the following information.

You must enter the following three pieces of information into their respective boxes: Click “Activate My Card.” after entering your Surge credit card credentials. Your card will be activated in a matter of seconds, and you can begin using the Surge card.

Login Procedure of SurgeCardInfo

You will be able to access your SurgeCardInfo account once your registration is successful. Verify that the credentials you created during registration are available before logging in.

Visit the SurgeCardInfo Login page at www.surgecardinfo.com.

Register with SurgeCardInfo. The registration portal is the same as before. Please fill in the appropriate fields with your username and password.

Click the “Submit” button to access your card account.

Password Recovery of SurgeCardInfo

You can reset your username by entering your account number, and you can reset your password by providing your username. To access your credit card information on the SurgeCardInfo Login page and log into your account, you will need your surge credit credentials.

Select the “Forgot Username” link by navigating to it. You will be taken to a new page by this and type your Social Security number and the last four digits of your account and your “Billing Zip Code” last. Select “Find Account.”

About SurgeCardInfo

One of America’s leading marketers and servicers of credit cards for people with less-than-perfect credit is Continental Finance Company (CFC). Since its inception, CFC has managed more than 2.6 million credit cards. We are proud of our excellent customer service and our access to cutting-edge products.

CFC, which was established in 2005, takes great pride in fulfilling its corporate responsibility to its customers by providing three fundamental characteristics: a solid program for helping customers, fair treatment, and responsible lending.

The products you can choose from are constantly evaluated with you, the customer, in mind. Both in print and online, clear and concise descriptions of the application and credit decision processes, fees and charges, and payment requirements are provided.

People with poor credit should consider applying for the Surge card. You can use this card to build your credit if you make regular payments and report it to the three major credit bureaus.

If you don’t care much about rewards, the fact that this card doesn’t give you rewards for making purchases shouldn’t be a problem. The objective is to provide this information to both current and potential customers in an entirely transparent manner.

Frequently Asked Questions

Can I Get a Credit Increase with the Surge Mastercard?

Yes, you can get a credit limit increase with the Surge Mastercard. When you make the minimum payment on the card within the first six months, you get qualified for a limit increase. This is one of the advantages of being a cardholder.

Is it possible for someone other than the cardholder to access invoices or make payments?

With the unique and secure ID and password set up in the app, cardholders can log in to the website, view their account information, and make payments to their accounts. This website may also be used by employees and agents of Continental Finance Company, LLC for quality assurance, customer service, account maintenance, or to maintain your account.

Can I activate a new credit card online?

The activation of new cards is only possible over the phone. Within 30 days of receiving your card in the mail, call the toll-free activation number printed on the label of your new card from the phone number provided in your application.

What Bank Issues the Surge Mastercard?

The Surge credit card is issued by Celtic Bank. This Bank also manages the account services of the card. This card is good option for you if you have a less than perfect credit.

What Credit Do I Need to Get the Surge Card?

Since the Surge card is designed for people with less than perfect credit, you can qualify for it with a bad FICO score. You improve your credit score with this card when you pay your bills on time for six consecutive months. Your credit limit will increase when you do this, thus improving your score.

Helpline

1-866-449-4514.Customer Service. 1-866-449-4514.Payments. 1-800-518-6142.Lost/Stolen Card. 1-800-556-5678.continentalfinance.net ›

Related Tags: SurgeCardInfo