Union Plus Credit Card – Since 1986, Union Plus has been providing benefits to labor union members, both current and former.

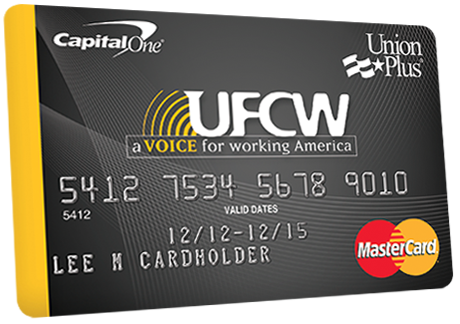

Union Plus Credit Card

They are qualified to receive a Capital One Union Plus credit card. Union Plus credit cards are available to members in three varieties.

Cash Rewards Credit Card, Primary Access, and Premium Rate Depending on their requirements and preferences, they can select any of them.

Numerous individuals have benefited from this program’s assistance in financial recovery.

This credit card is ideal for labor union members looking for a credit card. After making their first five monthly payments on time, you will also receive an increase in your credit limit.

A typical rewards card, the Union Plus Additionally, the card has a low-interest rate, no annual fee, and a 12-month interest-free period.

As if you had a Capital One rewards card, which has a higher interest rate but similar terms.

Workers can build credit and consolidate debt by using a union credit card.

A worker’s finances can be improved by using a card, which provides access to affordable loans and low-interest rates.

Higher productivity, lower employee turnover, improved workplace communication, and a workforce with better training are all linked to unions.

You can appreciate tasty, association family limits at these cafés and a lot more Whether it’s a night out or a pleasant family evening out on the town.

I have provided all of the necessary information in this post, Union Plus Credit Card login.

Benefits of Union Plus Credit Card

Ability to submit a Union Plus Scholarship Program application.

There are no yearly fees

Ability to apply for the Association In addition to Credit Program.

Credit lines ranging from $500 to $15,000

0% APR for a year The Union Plus Card even provides disaster assistance awards to individuals whose current work cannot fully support the fixes or additional items because of catastrophic events. This is conventionally a $500 grant.

Although we are aware that we have already informed you about the coupons, did you know that Explorers’ Protection could give you $100,000 in the event of a crisis?

Mishaps, wrongdoings, health-related crises, and a lot more fall under this category.

You can earn 1.5% cashback on all purchases, with no cap on how much you can earn in interest.

The Activation Process of Union Plus Credit Card

To begin, download the Union Plus mobile app to simplify your finances, keep track of your rewards, lock your card in case you lose it, and do other things.

Install your digital wallets, such as Apple Pay, Google Pay, Samsung Pay, Garmin Pay, Fitbit Pay, and so on.

You can then monitor your accounts, make payments, set up virtual cards, and more by enrolling in online banking with your SSN or TIN and credit card information.

Activate your Union Plus Virtual credit card. Your actual card information will remain hidden and protected by this.

Add the Eno from Association In addition to augmentation from your program and use it during web-based shopping.

Configure your PIN. Along with your card, you will receive a personal identification number (PIN).

You will need to call the number on the back of your card if you didn’t receive it or want to change the old one.

This PIN can be used to make international purchases and cash withdrawals from ATMs.

You will need to sign up for account access if this is your first time managing your account online.

On the welcome screen, click the “Register” button, which will take you to the page below.

Enter the last four digits of your Federal retirement aid number and your full Mastercard account number.

Enter the code for the signature panel and the date your card expires. Make a login ID and password. Enter your email address and confirm it.

Login Procedure of Union Plus Credit Card

Union members can manage their accounts online. This makes it simple to take full advantage of the card’s various benefits, including the ability to view reward balances and make payments.

You can access your Union Plus credit card account online at any time once you are logged in to the new Capital One system.

Log in to unionplus.capitalone.com by going to the top right corner of the home page.

Please check the “Remember me” box if you want to log in to your device. Enter the username and password that are associated with your Union Plus credit card online account.

Click the “Login” button to access the account.

Password Recovery of Union Plus Credit Card

Do not be concerned if you have forgotten any of your login information. To reset your username or password, just follow these easy steps.

First, visit the Association In addition to the card login page unionplus.capitalone.com

Then find the “Failed to remember Username or Secret word?” link.

After finding the link, select it.

On that page, verify your account.

Follow the instructions displayed and retrieve your username or password.

About Union Plus Credit Card

Capital One created the Union plus card, also known as the Union Plus Credit Card, which is relatively new.

Capital One Financial Corporation is an American bank holding company with its headquarters in McLean, Virginia, and most of its operations in the United States.

It specializes in credit cards, auto loans, banking, and savings accounts.

Capital One is the third-largest credit card issuer in the United States, Canada, and the United Kingdom, following JPMorgan Chase and Citigroup.

The bank had 755 branches as of December 31, 2018, including 30 café-style locations and 2,000 ATMs.

It operates in the United States, Canada, and the United Kingdom and is ranked 99th on the Fortune 500 and 9th on Fortune’s list of the 100 Best Companies to Work For.

In the 1990s, the company was a pioneer in the widespread marketing of credit cards.

It came in fifth place in terms of purchase volume in 2016 behind American Express, JPMorgan Chase, Bank of America, and Citigroup as the largest credit card issuer.

With credit cards accounting for 47.3% of total loans outstanding, Capital One had $107.350 billion in outstanding credit card loans in the United States and $9.011 billion in outstanding credit card loans in Canada and the United Kingdom.

Frequently asked questions

Which credit score do you need for a Union Plus credit card?

You will need Credit Scores from 300 to 670+ to Apply Union Plus aims its cards at folks with fair or poor credit scores.

You can come across a review that indicates a recommended credit score range of 300 to 670.

What places give union discounts?

You can enjoy delicious, union family discounts at these restaurants and many more Whether it’s date night or a fun family night out.

You can enjoy IHOP, Macaroni Grill, Maggiano’s, Lebanese Taverna, Carrabba’s Italian Grill, Bonefish Grill, Johnny Rockets, Little Caesars, and More items.

Can I add an authorized user to my card?

You can add authorized users online after you sign in, or you can call the number on the back of your card.

Please note that to add an authorized user to your account, you must be the primary cardholder, secondary cardholder, power of attorney, or small business account manager.

Adding a user can be done only if you’ve already been approved—not during the application process.

We do not offer the option for co-applicants at this time, but you may add an authorized user after your account is opened.

Helpline

Union Plus credit card apply via Phone number: 1-800-522-4000

customer service number: 1-800-622-2580

Corporate card phone number: 1-800-477-3070

Card Activation phone number: 1-800-622-2580

Application status phone number: 1-800-651-5114

For technical support number: 1-866-406-869

Conclusion

I appreciate you taking the time to read this far; I have provided all of the necessary information regarding the Union Plus Credit Card.

I hope you found the information provided above easy to understand. Thank you, and enjoy your day.

Related Tags: Union Plus Credit Card